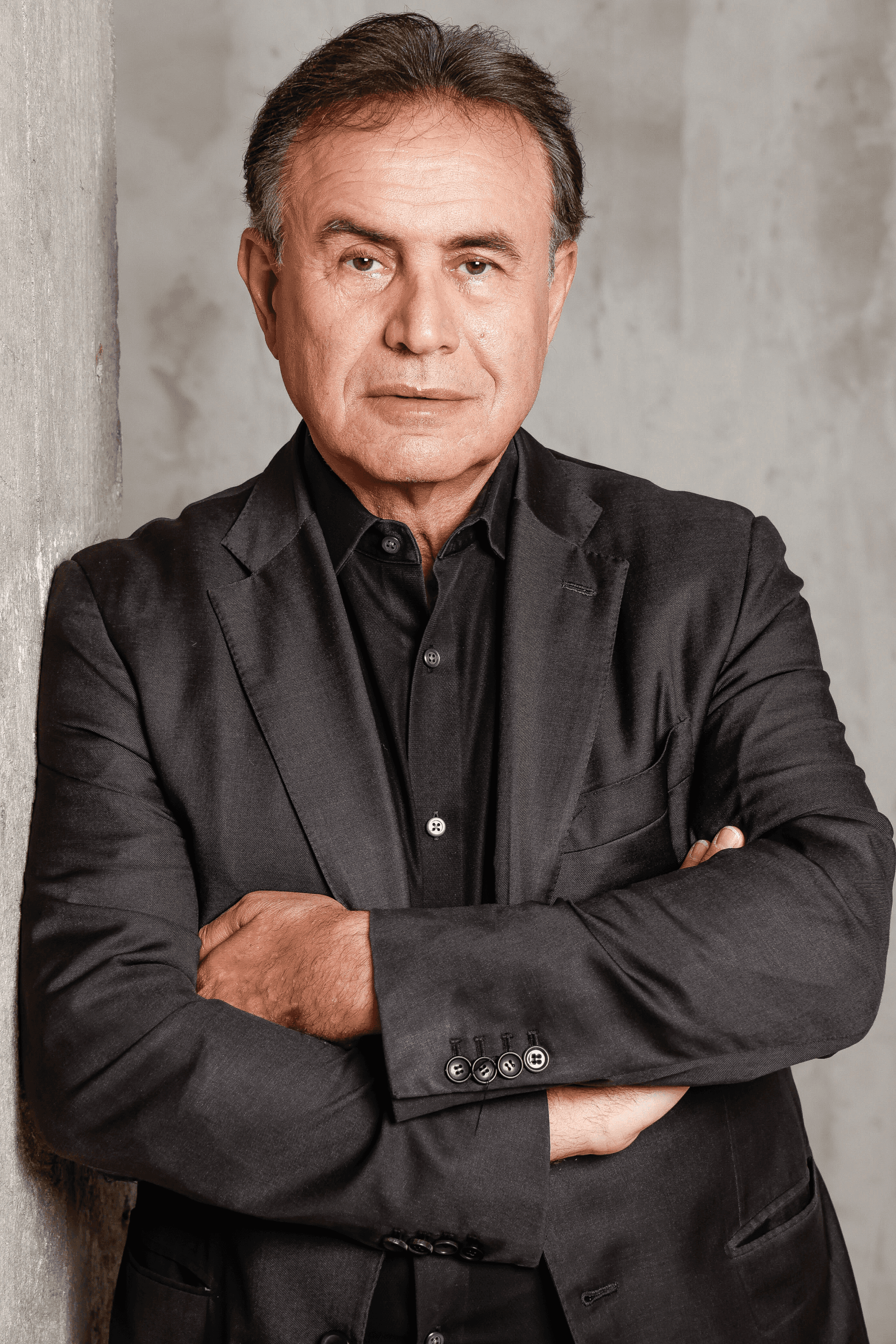

CEO of Roubini Macro Associates, Chief Economist for Atlas Capital Team L.P., & Professor Emeritus Stern School of Business, New York University

Jan 21, 2026, 3:30 PM

ET

Tech Trumps tariffs: Why US exceptionalism and the dollar exorbitant privilege are not over

Tech Trumps tariffs: Why US exceptionalism and the dollar exorbitant privilege are not over

As tariff wars escalate and deglobalization reshapes trade flows, a growing chorus warns that American economic dominance is ending—that China's manufacturing prowess, BRICS currency initiatives, and the weaponization of the dollar through sanctions will finally dethrone the greenback and erode U.S. financial hegemony. Yet despite mounting protectionist pressures, geopolitical fragmentation, and the largest trade barriers since the 1930s, the structural foundations of American exceptionalism remain remarkably resilient. The question facing executives, investors, and policymakers is not whether the U.S. faces challenges, but whether those challenges fundamentally alter the architecture of global economic power—or simply reinforce existing advantages in unexpected ways.

Dr. Roubini, who famously predicted the 2008 financial crisis and has spent decades analyzing currency crises, sovereign debt dynamics, and the rise and fall of economic powers, will argue that reports of America's decline are premature. While tariffs create friction and political theater, the underlying drivers of U.S. dominance—technological superiority, deep capital markets, the network effects of dollar liquidity, and an innovation ecosystem that remains unmatched—create self-reinforcing competitive moats that rivals cannot easily replicate. Silicon Valley continues to lead in AI, quantum computing, and biotechnology. U.S. equity markets represent over 60% of global market capitalization. And despite predictions of de-dollarization for decades, 88% of global foreign exchange transactions still involve the dollar.

The strategic stakes are substantial: Technology supremacy in AI and semiconductors gives the U.S. asymmetric leverage over global supply chains—leverage that tariffs alone cannot erase. Financial market depth means that even as Treasury yields fluctuate, there is no alternative venue that can absorb trillions in capital flows. The SWIFT payment system, clearing mechanisms, and the dollar's role as the unit of account for commodities from oil to gold create dependencies that take generations to unwind, not election cycles. Meanwhile, China's capital controls, legal system opacity, and political risk make the renminbi structurally unsuited for reserve currency status, while Europe's fragmented fiscal policy and institutional paralysis limit the euro's global appeal.

Dr. Roubini will address the counterarguments: Can BRICS nations create a viable alternative currency bloc? Will digital currencies and central bank digital currencies (CBDCs) disrupt dollar dominance? Could the U.S. fiscal trajectory—$35 trillion in debt and rising—finally undermine confidence in Treasuries? And what happens if tariff wars escalate into true economic blocs where trade flows bypass dollar settlement entirely? Yet even here, the data suggests limits to de-dollarization: Oil contracts remain dollar-denominated, global debt is dollar-denominated, and when liquidity crises emerge—as they did in 2008, 2020, and will again—the Federal Reserve remains the lender of last resort to the world.

This conversation will provide the framework to assess whether the current era of tariffs, industrial policy, and geopolitical competition truly threatens U.S. economic primacy—or paradoxically reinforces it by exposing the lack of viable alternatives. Dr. Roubini has studied currency collapses, reserve currency transitions, and the rise of new economic powers across history. Join us for a rare opportunity to hear from one of the world's most prescient economic minds on why American exceptionalism and dollar dominance may be more durable than consensus believes—and what that means for your business, your portfolio, and the global economic order for the next decade.

As tariff wars escalate and deglobalization reshapes trade flows, a growing chorus warns that American economic dominance is ending—that China's manufacturing prowess, BRICS currency initiatives, and the weaponization of the dollar through sanctions will finally dethrone the greenback and erode U.S. financial hegemony. Yet despite mounting protectionist pressures, geopolitical fragmentation, and the largest trade barriers since the 1930s, the structural foundations of American exceptionalism remain remarkably resilient. The question facing executives, investors, and policymakers is not whether the U.S. faces challenges, but whether those challenges fundamentally alter the architecture of global economic power—or simply reinforce existing advantages in unexpected ways.

Dr. Roubini, who famously predicted the 2008 financial crisis and has spent decades analyzing currency crises, sovereign debt dynamics, and the rise and fall of economic powers, will argue that reports of America's decline are premature. While tariffs create friction and political theater, the underlying drivers of U.S. dominance—technological superiority, deep capital markets, the network effects of dollar liquidity, and an innovation ecosystem that remains unmatched—create self-reinforcing competitive moats that rivals cannot easily replicate. Silicon Valley continues to lead in AI, quantum computing, and biotechnology. U.S. equity markets represent over 60% of global market capitalization. And despite predictions of de-dollarization for decades, 88% of global foreign exchange transactions still involve the dollar.

The strategic stakes are substantial: Technology supremacy in AI and semiconductors gives the U.S. asymmetric leverage over global supply chains—leverage that tariffs alone cannot erase. Financial market depth means that even as Treasury yields fluctuate, there is no alternative venue that can absorb trillions in capital flows. The SWIFT payment system, clearing mechanisms, and the dollar's role as the unit of account for commodities from oil to gold create dependencies that take generations to unwind, not election cycles. Meanwhile, China's capital controls, legal system opacity, and political risk make the renminbi structurally unsuited for reserve currency status, while Europe's fragmented fiscal policy and institutional paralysis limit the euro's global appeal.

Dr. Roubini will address the counterarguments: Can BRICS nations create a viable alternative currency bloc? Will digital currencies and central bank digital currencies (CBDCs) disrupt dollar dominance? Could the U.S. fiscal trajectory—$35 trillion in debt and rising—finally undermine confidence in Treasuries? And what happens if tariff wars escalate into true economic blocs where trade flows bypass dollar settlement entirely? Yet even here, the data suggests limits to de-dollarization: Oil contracts remain dollar-denominated, global debt is dollar-denominated, and when liquidity crises emerge—as they did in 2008, 2020, and will again—the Federal Reserve remains the lender of last resort to the world.

This conversation will provide the framework to assess whether the current era of tariffs, industrial policy, and geopolitical competition truly threatens U.S. economic primacy—or paradoxically reinforces it by exposing the lack of viable alternatives. Dr. Roubini has studied currency collapses, reserve currency transitions, and the rise of new economic powers across history. Join us for a rare opportunity to hear from one of the world's most prescient economic minds on why American exceptionalism and dollar dominance may be more durable than consensus believes—and what that means for your business, your portfolio, and the global economic order for the next decade.